China has just put a heavier hand on its exports of rare earth elements and the technologies around them. That move reframes who holds the power in global supply chains—and what businesses, governments, and tech players must do next.

What’s Changed: A Closer Look at the New Controls

- China now requires export licenses for even tiny trace amounts of Chinese-sourced rare earths in foreign shipments.

- The restrictions expand to technology linked with mining, smelting, recycling, and magnet production.

- For defense-related uses, export licenses will generally be denied. Meanwhile, exports tied to semiconductors will be reviewed case by case.

- China is also forbidding domestic firms from collaborating with foreign companies in rare earths without prior government approval.

- The rules now extend to imported minerals too—any material processed inside China must be tracked and reported.

These latest constraints are a step up from earlier rules announced in April, which already narrowed access to seven key rare earths and magnets.

Why China Is Doing This: Strategy Over Surprise

This isn’t just about control. It’s a calculated leverage play.

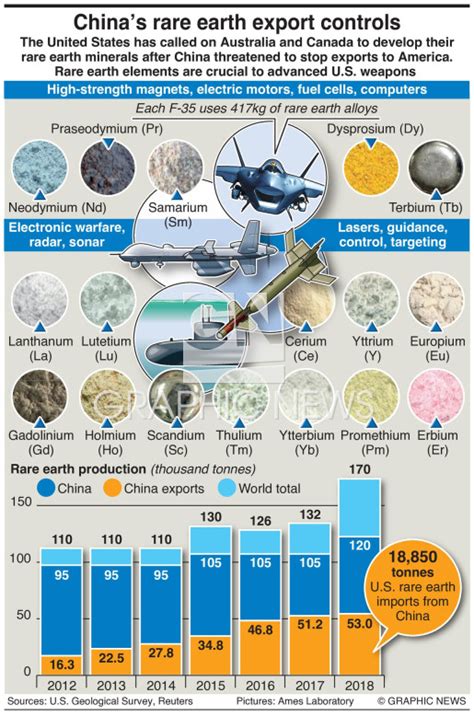

- National security is the stated rationale. China argues that dual-use aspects of rare earths—think military tech and civilian applications—require stricter oversight.

- The move gives Beijing negotiating power in trade talks. The U.S. and China link these controls to broader disputes over tech, tariffs, and supply chains.

- Controlling the tech for refining and processing strengthens China’s grip, even if other countries find or mine rare earths.

- It sends a message: China believes the West’s ability to build defense systems, green energy tech, and advanced electronics is vulnerable without it.

Shockwaves Across Global Industries

Auto, Renewable, & Electronics Sectors

Permanent magnets made with rare earths power electric vehicle motors, wind turbines, and precision electronics. When China cut shipments, automotive factories in Europe paused, and parts suppliers scrambled.

In May, China’s magnet shipments fell by 53%, hitting their lowest level in years.

Defense & Security

Foreign military projects relying on rare earths face increasing uncertainty. Under the new regime, China denies such exports almost automatically.

The U.S. sees it as a twist in trade diplomacy—rare earths now intersect with high-tech export rules like semiconductors.

Economic Pain at Home

Chinese firms aren’t immune. The export bottlenecks add drag to domestic growth. Some magnet producers report sharp drops in overseas orders.

More broadly: supply chain disruption, delays, and higher costs are rippling across industries in and out of China.

Responses & Adjustments

Diplomatic Pressure

The EU pushed Beijing to ease restrictions. In July, China agreed to an “upgraded supply mechanism” to help unblock bottle.

Meanwhile, the U.S. and China reached a truce that could accelerate rare earth exports.

But some in industry say the relief is minimal—the licensing process still frustrates buyers.

Supply Chain Diversification

Companies are rushing to build processing capability outside China. Australia’s Lynas struck a deal with U.S. firms to supply magnets.

Many governments are accelerating “friend-shoring” of critical mineral projects.

Risks Ahead & What to Watch

- The licensing system might choke supply further—delays, rejections, or unclear rules.

- Price spikes and volatility for the controlled rare earths and magnet materials.

- Retaliatory moves: more export bans, tougher import rules, or regulatory escalation.

- New supply chains may take years to get online—there’s no instant substitute for China’s scale.

- Political risk: China might use these controls as bargaining chips tied to other sectors.

What Businesses and Policy Makers Should Do

- Audit supply dependencies — know which rare earths feed your core products.

- Seek alternate sources — invest in mines, refineries, and processing outside China.

- Forge alliances — collaborate with allies to share tech, resources, and leverage.

- Build buffer stocks — keep more inventory to weather licensing hiccups.

- Engage politically — pressure your governments to support critical mineral strategies.

China’s move to tighten export controls on rare earths and related technologies is a reminder that global supply chains are political too. Power now flows not just through trade volumes, but through control of the bottlenecks. Governments and industries alike will need to catch up fast—or watch opportunity slip away.